- Loan period- the tenure is the while the fresh new debtor should repay the new AXIS Lender Financial. The new EMI are ultimately associated with period. The extended the mortgage period, the least expensive EMI would be. Very financing of three decades will have less EMI as compared to good 10-season mortgage.

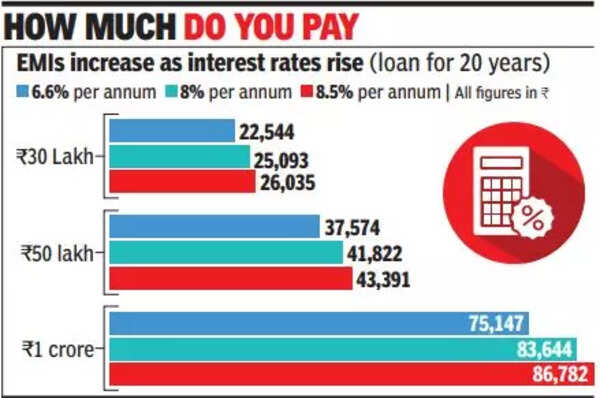

- Interest rate- the higher the rate out-of financing, the greater may be the EMI count. Incase brand new EMI number are highest, that means the cost of the mortgage is actually large. Hence, how to reduce the EMI is to look for a financial which have less interest. AXIS Bank Mortgage rate of interest initiate during the six.nine percent.

- Loan amount- the mortgage amount escalates the EMI. Higher your debt number, large EMI. A minimal loan amount alternative in this new AXIS Bank House Mortgage EMI Calculator are Rs. step 3 lakhs, plus the limitation is Rs. 5 crores.

Calculating EMI playing with Axis Financial Financial EMI Calculator

Example: Mr. X submits a loan application to locate an enthusiastic AXIS Financial Financial of loan amount Rs. 50 lakhs in the an interest rate of nine per cent, as well as the mortgage tenure was two decades. They normally use the brand new AXIS Bank Mortgage EMI Calculator so you’re able to estimate brand new EMI for the 240 months.

Apart from simply figuring this new month-to-month cost payment number, the fresh AXIS Financial Financial EMI Calculator even offers the latest amortization plan.

Axis Bank Home loan Amortization Calculation

A keen amortization schedule include recommendations exhibiting the brand new department of EMI count towards appeal costs and you will dominant repayment. Additionally suggests brand new outstanding balance of the financing. The latest debtor have access to that it amortization agenda using the AXIS Financial Mortgage EMI Calculator .

Since the payment ages improvements, its viewed you to definitely on full EMI matter, the main fees number keeps expanding, while loans in Penton without credit check the interest area decrease. This is because, due to the fact principal gets paid, new a fantastic balance about what the interest are computed also reduces. Hence the attention matter reduces.

Advantages of choosing Axis Financial Home loan EMI Calculator

Besides which have easy access to so it on the web AXIS Financial Family Financing EMI Calculator , you will find several a lot more benefits of using it.

- Convenience- regardless of how repeatedly one desires, they’re able to use it so you’re able to assess the fresh new EMI level of more financing period and you will numbers. It automated tool usually, without any doubt, help decide which EMI plan suits all of them most readily useful.

- Simple to use- brand new AXIS Bank Mortgage EMI Calculator has an easy software and this can be manage because of the people without having any problem. Only go into most of the required info, and you will within a few minutes, brand new calculator can give brand new EMI number as well as the amortization plan.

- Done accuracy- using this type of calculator, one could steer clear of the chance of and work out formula problems when trying to by hand estimate the fresh EMI amount. This new calculator is set to incorporate precise EMI numbers this one usually pay back in the event that financing is pulled.

- Simple to contrast- a different advantageous asset of utilising the AXIS Financial Mortgage EMI Calculator is that one can contrast multiple loan EMIs effortlessly. To the instant results considering, it gets simple so you can calculate, as numerous fund EMIs with various period, amounts, and rates of interest even off additional finance companies. And base the decision about research.

End

Axis Lender really does their best to render lenders that will feel sensible for the majority of their users. The eye rates is actually possible, and there is independence on the installment. As well as, by giving accessibility the web AXIS Bank Mortgage EMI Calculator , the bank makes simple to use for their individuals to plan and evaluate some mortgage agreements.